About Simplifi by Quicken

Simplifi by Quicken, a streamlined money management app, aims to take the complexity out of your finances. Ditch the spreadsheets and clunky software – Simplifi brings everything together in a clear, user-friendly interface. Track your income and expenses, monitor your budget, and stay on top of bills, all in one place.

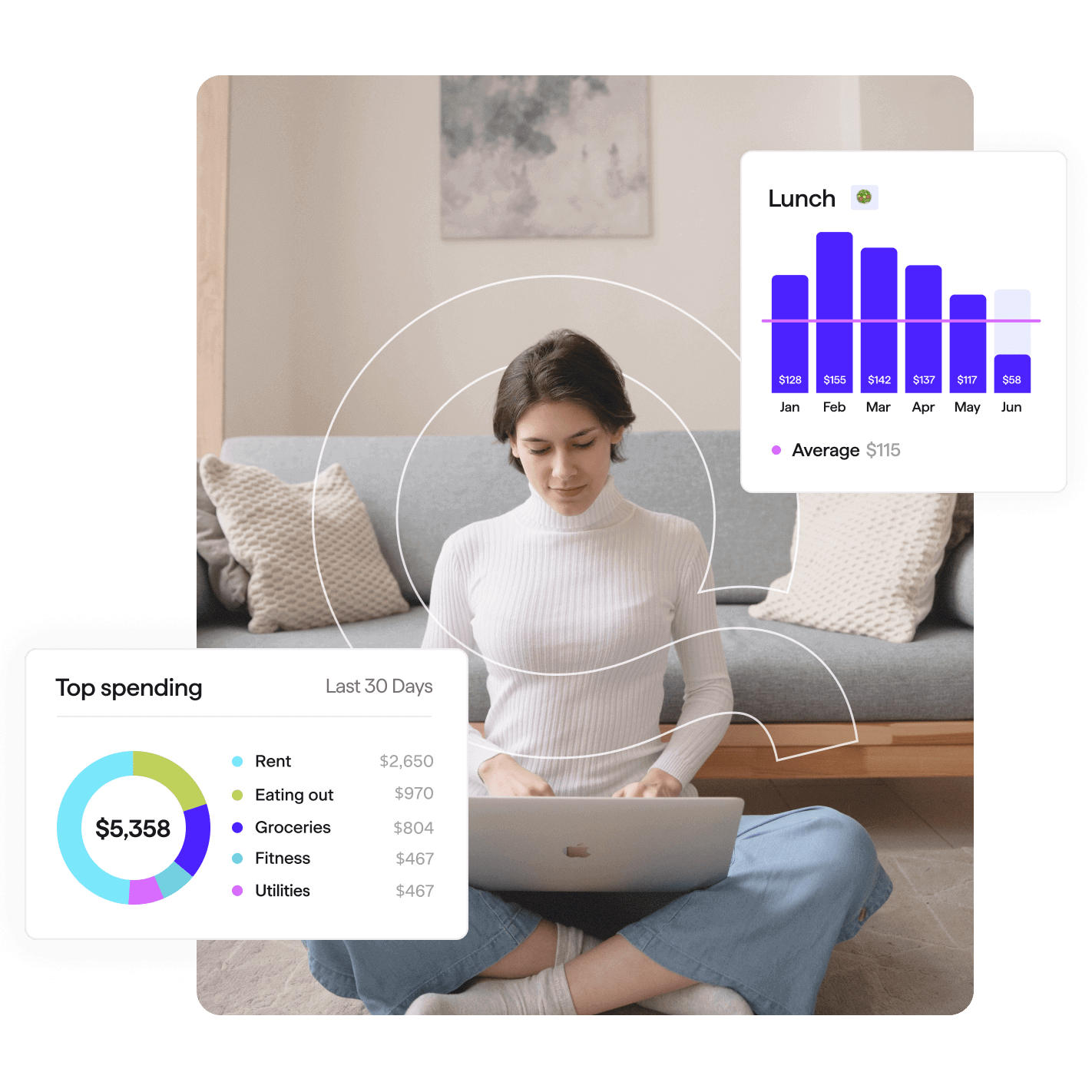

Imagine having a financial assistant in your pocket, whispering money-saving tips and nudging you towards your goals. That’s Simplifi! It categorizes your transactions automatically, highlights spending patterns, and even predicts future balances. Say goodbye to guesswork and hello to financial confidence.

But Simplifi isn’t just about tracking – it’s about taking control. Set savings goals, automate transfers, and schedule bill payments so you never miss a deadline again. The app empowers you to make informed decisions, build financial security, and ultimately, achieve your financial dreams.

Simplifi by Quicken Features Review

Imagine saying goodbye to financial spreadsheets and clunky software – that’s where Simplifi steps in. It’s a money management app designed to simplify your finances, offering a crystal-clear interface and powerful tools to track your money, budget effectively, and stay on top of bills.

Think of Simplifi as your personal financial whisperer, tucked away in your pocket. It automatically categorizes transactions, tracks spending patterns, and even predicts future balances, giving you insights you never knew you needed. No more guesswork, just confidence in knowing where your money goes.

But Simplifi isn’t just about observing your finances, it’s about taking the reins. Set goals for savings, automate transfers, and schedule bill payments. Breathe easy knowing deadlines are met and your financial future is on autopilot.

Empower yourself to make informed decisions, build a secure financial foundation, and ultimately, achieve your financial dreams. Simplifi removes the stress and complexity, bringing simplicity and control back to your money.

How Does Simplifi by Quicken Work?

Simplifi by Quicken works like your friendly financial autopilot, seamlessly connecting various parts of your financial life in a user-friendly interface. Here’s the breakdown:

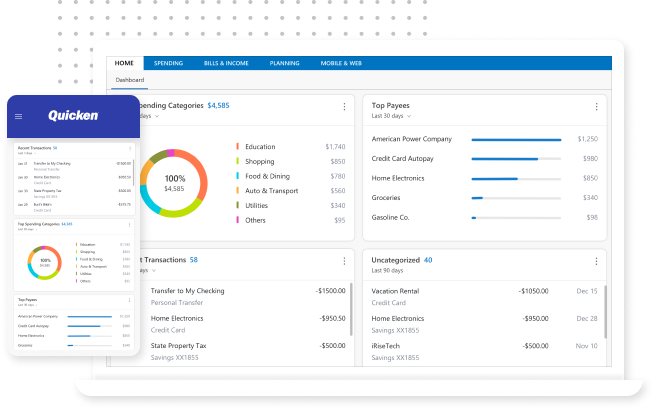

Connecting your accounts: Simplifi lets you connect your bank accounts, credit cards, and investment accounts. This gives it a complete picture of your financial inflows and outflows. You can choose automatic connection for supported institutions or manually enter transactions if needed.

Automatic organization: Once connected, Simplifi automatically categorizes your transactions, saving you hours of manual tagging. It uses smart algorithms to identify spending patterns and assign categories like groceries, rent, or entertainment. You can customize these categories if needed.

Budgeting and goal setting: Define your monthly spending limits and savings goals for specific categories. Simplifi tracks your progress against these goals in real-time, giving you instant feedback and helping you stay on track.

Bill management: Stay ahead of deadlines with automated bill payments and reminders. Simplify takes the hassle out of remembering due dates and ensures you never miss a payment.

Insights and predictions: Go beyond basic tracking with Simplifi’s predictive analytics. It analyzes your spending patterns and predicts future balances, helping you make informed financial decisions and plan ahead.

Alerts and notifications: Stay informed with timely alerts about unusual spending, upcoming bills, and nearing budget limits. This way, you can always keep an eye on your finances and proactively manage any potential issues.

Additional features: Simplifi offers various other features to enhance your financial management, like tracking investments, setting investment goals, and exporting data for further analysis.

Simplifi works by simplifying the connection between your financial accounts, automating tedious tasks, and providing actionable insights to help you make informed decisions and achieve your financial goals.

Simplifi by Quicken Fees

Simplifi by Quicken offers two ways to access its features: a monthly subscription and a discounted annual plan.

Monthly Subscription:

- Starts at $2.79 per month, billed monthly.

- Provides access to all Simplifi features.

- Gives you flexibility to adjust or cancel your subscription at any time.

Annual Plan:

- Starts at $28.73 per year, billed annually (equivalent to $2.39 per month).

- Provides all features of the monthly subscription.

- Saves you 25% compared to the monthly plan.

- Requires a year-long commitment.

The best option for you depends on your individual needs and preferences. If you prefer flexibility and want to try Simplifi out for a while before committing to a longer plan, the monthly subscription might be the better choice. However, if you’re sure you’ll be using Simplifi for a year and want to save some money, the annual plan is the more cost-effective option.

Who Is Simplifi by Quicken For?

Simplifi by Quicken targets a specific range of individuals seeking a user-friendly, streamlined approach to managing their finances. Here’s a breakdown of who might benefit most from using Simplifi:

Young professionals: Simplifi’s modern interface and emphasis on automatic categorization and insights cater well to the tech-savvy generation entering the workforce and navigating their first steps towards financial independence.

Budget-conscious individuals: If you’re looking for a tool to effectively track spending, set realistic budgets, and stay on top of bills, Simplifi’s automated features and goal-setting tools can be your key to achieving financial stability.

Individuals seeking financial clarity: Simplifi excels at simplifying complex financial information. If you’re overwhelmed by spreadsheets or struggle to understand where your money goes, Simplifi’s intuitive interface and insights can offer much-needed clarity.

People on the go: With mobile app availability, Simplifi is ideal for those who need to manage their finances on the move. Track spending, review budgets, and stay informed about upcoming bills wherever you are.

Individuals seeking a simple step into financial planning: If you’re new to financial planning or haven’t found the right tool yet, Simplifi’s ease of use and approachable features make it a good starting point to build healthy financial habits.

Experienced investors: Those with complex investment portfolios may require more advanced tools than Simplifi offers.

People with extensive debt: While Simplifi can help manage ongoing debt, it might not be as effective for tackling significant existing debt.

Individuals who prefer complete manual control: If you enjoy manually categorizing transactions and prefer a highly customizable budget experience, Simplifi’s automated features might not offer enough flexibility.

Simplifi is a powerful tool for individuals seeking a user-friendly way to manage their finances and gain valuable insights into their spending habits. Whether you’re just starting out or looking for a simpler approach, Simplifi could be a great fit for your needs.

Simplifi by Quicken Reviews: What Do Customers Think?

Simplifi by Quicken has received a generally positive reception from users, but like any app, it has its strengths and weaknesses as reflected in customer reviews. Here’s a summary of what people are saying:

- Ease of use: Many users praised Simplifi’s clean and intuitive interface, making it easy to navigate and track finances. Automatic transaction categorization and clear visualization of spending were key highlights.

- Budgeting and goal setting: The app’s budgeting tools and goal-setting features were appreciated for their flexibility and effectiveness in helping users stay on track and achieve financial goals.

- Insights and predictions: Users loved the ability to gain insights into their spending habits and predict future balances, leading to better financial planning and decision-making.

- Mobile app: The mobile app was praised for its convenience and functionality, allowing users to manage their finances on the go.

Despite some shortcomings, most users found Simplifi a valuable tool for managing their finances. Its ease of use, powerful budgeting and insights features, and mobile app convenience outweigh the minor negatives for many users. However, the subscription cost and limited investment tracking might be dealbreakers for some.

Is Simplifi by Quicken Worth It?

Whether Simplifi by Quicken is “worth it” depends entirely on your individual needs and financial goals. Here’s a breakdown of its pros and cons to help you decide:

- Simple and intuitive: The clean interface and automatic transaction categorization make managing your finances effortless, particularly for beginners.

- Budgeting and goal setting: Set realistic budgets and track your progress towards financial goals with ease, receiving helpful nudges and insights along the way.

- Financial clarity: Gain valuable understanding of your spending habits through automated insights and predictions, empowering you to make informed financial decisions.

- Mobile app: Manage your finances on the go with the convenient mobile app, keeping you on top of your budget and bills anytime, anywhere.

The decision of whether Simplifi is “worth it” comes down to your priorities. If you’re looking for a user-friendly way to track your finances, set budgets, and gain valuable insights, Simplifi could be a great fit. However, if you have complex investment needs or prefer a highly customizable approach, you might find limitations.

Simplifi by Quicken Promotions & Discounts

Simplifi by Quicken is a fantastic budgeting app that can help you take control of your finances. And good news – there are several ways to snag it for less! Here are some current promotions and discounts to keep your eye on:

1. New Member Offer: New users can enjoy 10% off any Simplifi plan, giving you a chance to test out the app’s features before committing to a full subscription. This offer is a great way to dip your toes into the world of Simplifi without breaking the bank.

2. Annual Plan Discount: If you know you’ll be using Simplifi for the long haul, opting for the annual plan will save you money. You’ll pay just $28.73 per year, which is equivalent to $2.39 per month – a 25% discount compared to the monthly subscription! Not only will you save some cash, but you’ll also enjoy the convenience of having your subscription paid for all year round.

3. Quicken Deals & Promo Codes: Keep an eye out for special deals and promo codes offered by Quicken directly. They often have limited-time promotions that can give you even deeper discounts on Simplifi subscriptions. You can check their website, social media channels, and email newsletters for the latest offers.

4. Refer a Friend: Tell your friends about Simplifi and get rewarded! When you refer a friend and they sign up for a paid subscription, you’ll both receive a free month of Simplifi. It’s a win-win situation – you help your friend take control of their finances, and you get a little bonus for yourself.

5. Free Trial: Not sure if Simplifi is right for you? No problem! Quicken offers a free 30-day trial of Simplifi, so you can try out all the features and see if it’s a good fit for your needs. This is a great way to get a feel for the app before making a commitment.

By taking advantage of these promotions and discounts, you can save money on Simplifi and start your journey towards financial freedom. Remember, the best way to find the best deal is to do your research and compare different options. With a little effort, you can find the perfect way to get started with Simplifi and take control of your finances.

How To Get Started On Simplifi by Quicken

Excited to dive into Simplifi by Quicken and conquer your finances? Here’s a friendly roadmap to get you started:

1. Download and Install:

- Head over to Quicken’s website and download Simplifi for your preferred device (desktop or mobile).

- Follow the installation instructions and get ready to launch!

2. Connect Your Accounts:

- Simplifi needs to know where your money lives. Link your bank accounts, credit cards, and other financial institutions securely.

- Don’t worry, Simplifi uses bank-level security to keep your data safe.

3. Personalize Your Dashboard:

- Make Simplifi your own! Customize your dashboard with widgets that show you what matters most, like spending trends, account balances, and upcoming bills.

- Drag and drop, prioritize, and find your financial sweet spot.

4. Track Your Spending:

- Simplifi automatically categorizes your transactions, making it easy to see where your money goes.

- Dive deeper with detailed reports and insights to identify spending patterns and areas for improvement.

- Budgeting becomes a breeze with built-in tools to set goals and track your progress.

5. Stay on Top of Bills:

- Never miss a payment again! Simplifi keeps you organized with bill reminders and due date alerts.

- Schedule automatic payments for recurring bills and simplify your financial life.

6. Grow Your Wealth:

- Simplifi helps you invest smarter with tools like portfolio tracking and goal-based planning.

- Explore investment options and make informed decisions to reach your financial goals faster.

With Simplifi by your side, managing your finances becomes a breeze. So, go forth, conquer your financial goals, and enjoy the journey!

FAQ

What is Simplifi?

Simplifi is a personal finance app by Quicken that simplifies (get it?) managing your money. It connects your accounts, tracks spending, helps you budget, and guides you towards achieving your financial goals.

Does it cost anything?

Simplifi offers a free version with basic features, while the premium tier unlocks enhanced tools like bill autopay, advanced budgeting, and investment tracking.

Is it safe?

Absolutely! Simplifi uses bank-level security to protect your data and keep your finances secure.

Can I import data from other apps?

Yes, Simplifi lets you import data from various personal finance tools, making it easy to switch and get started quickly.

What about non-US bank accounts?

Currently, Simplifi primarily supports US-based bank accounts and financial institutions.

Can I share my data with anyone?

Yes, you can share your Simplifi data with a partner or financial advisor to collaborate on your financial goals.

Where can I learn more?

Quicken offers a comprehensive Help Center, blog, and educational resources packed with tips and tricks to make the most of Simplifi.