Financial planning is a key part of any successful lifestyle. It’s important to know where your money is going and how to save for the future. However, many people find it hard to take control of their finances due to a number of factors. In this article, we will discuss some tips on how to take control of your finances and achieve success in the long term. We’ll also outline some traps you may fall into if you’re not careful, and provide some advice on how to overcome them.

Understand Your Financial Situation

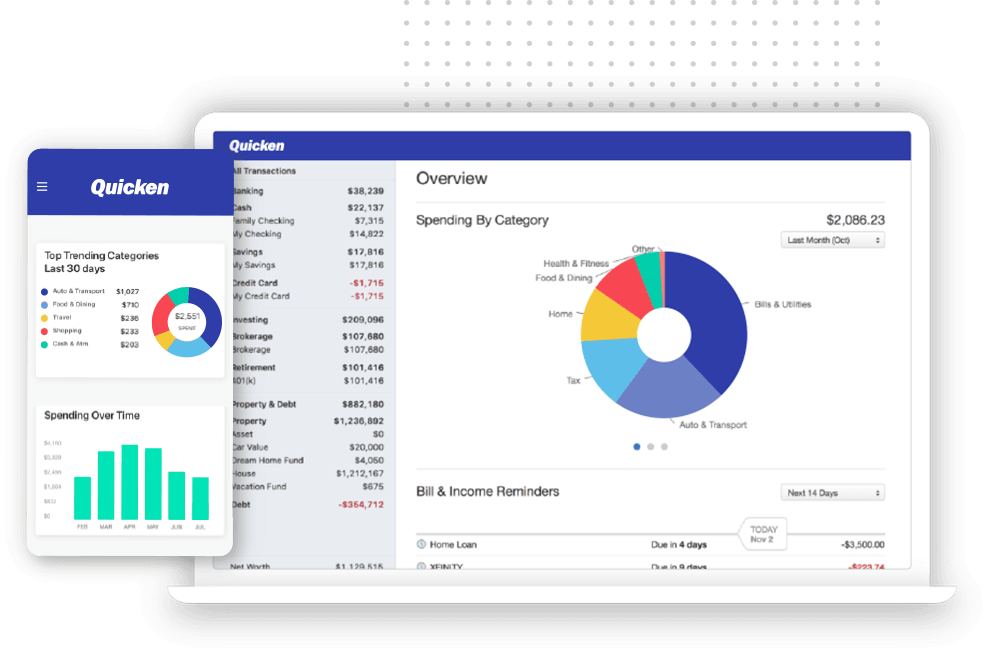

Image Source: Link

People who have good finances know how to save, manage their expenses, and invest for the future. Here are some tips on how to take control of your finances:

- Start with a budget. Create a budget that reflects your income and expenses. This will help you understand where your money is going and help you make better decisions about spending.

- Set savings goals. Set a goal for how much money you want to save each month. This will help you stay on track and reach your financial goals.

- Pay off debtors first. If you have debts that are more expensive than the interest rate on your loans, pay off those debts first to reduce how much money you need to spend each month on interest payments.

- Invest in stocks and bonds wisely. Don’t overspend on stocks or bonds without knowing what the long-term returns will be; instead,invest in mutual funds or exchange-traded funds (ETFs) that track specific indices or indexes such as the S&P 500 or the Dow Jones Industrial Average (DJIA). ETFs offer diversification benefits, making them a good option for those who don’t have time to study individual stocks or bonds carefully.

Make a Budget

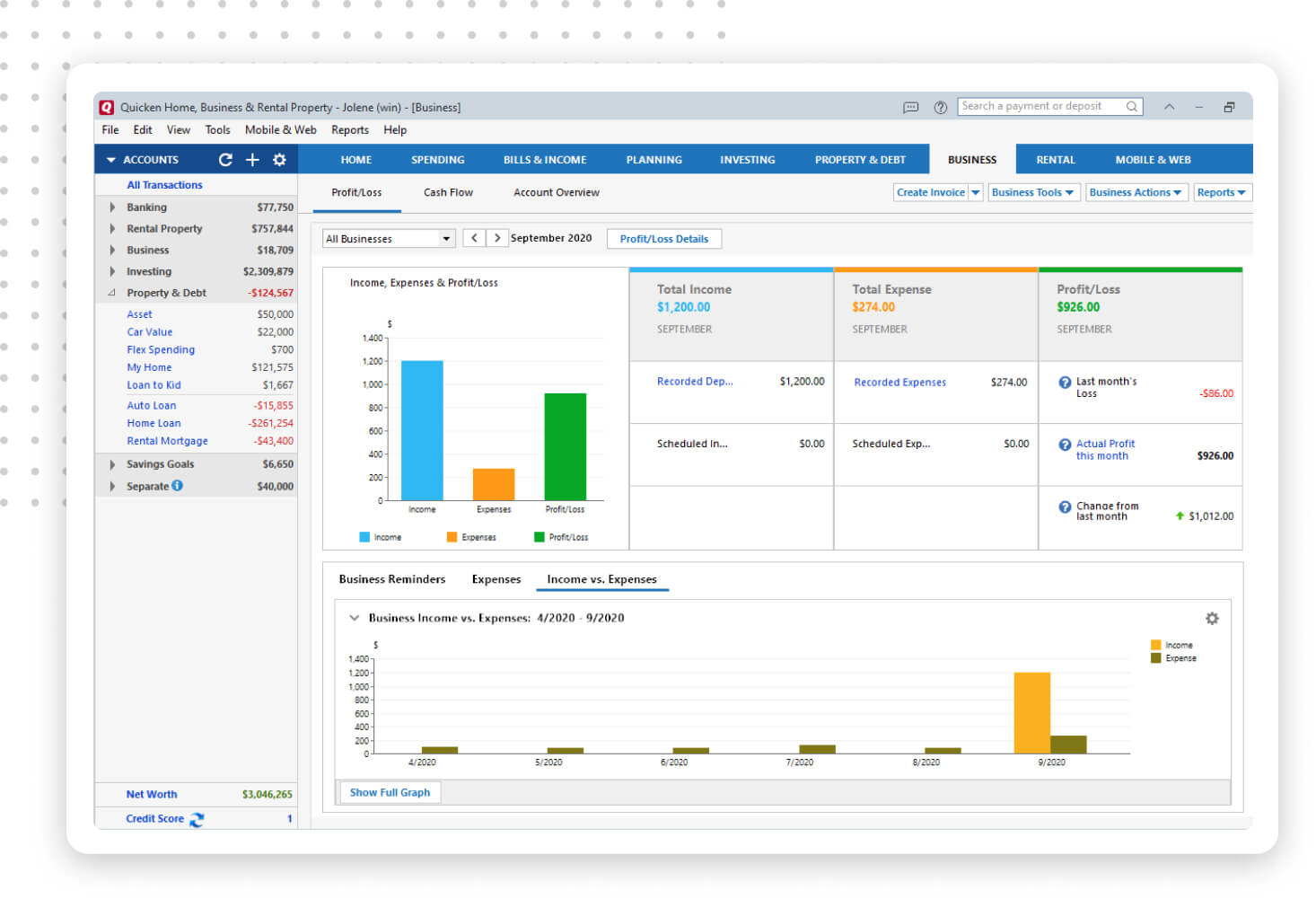

Image Source: Link

Start by making a list of your expenses. Include everything from the small, everyday things to the big-ticket items. Once you have a complete list, start categorizing them into one or more expense categories. Next, create separate budget lines for each category. This will help you track your progress and see where you can make cuts to save money. You may also want to include specific deadlines for when you want to hit certain savings goals. Finally, make sure you are using a consistent method for tracking your spending so you can see trends and adjust your budget accordingly.

Save for Your Future

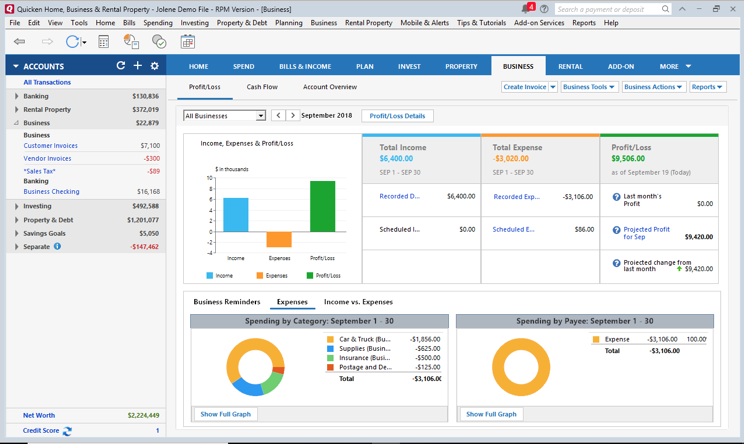

Image Source: Link

If you want to take control of your finances, here are 6 steps you can take:

1. Make a budget.

Creating a budget is the first step in controlling your finances. By understanding what you spend each month, you’ll be able to pinpoint where you need to cut back in order to save money for your future.

2. Start with your biggest expenses.

One of the best ways to save money is by cutting out expensive habits, like eating out or buying things unnecessary online. Start with your biggest expenses and work your way down.

3. Save regularly and systematically.

It’s important to have a savings plan — whether it’s having set aside money every month or investing in a high-yield account, having something set up will help motivate you to stick to it. Automating your savings process can also help decrease the amount of stress involved with saving money for the future.

4. Cut down on cable TV and other unnecessary bills.

Cable TV and other high-cost streaming services are one of the easiest ways to rack up big bills without really getting anything in return. Try watching less television overall or look into cutting the cord completely and using services like Netflix or Hulu instead. Cutting these costs can really add up over time!

Understand Your Credit Score

Image Source: Link

Credit utilization is the percentage of your credit card debt compared to your available credit.

Generally speaking, a high utilization rate indicates that you’re using more of your available credit than is ideal. A low utilization rate means you’re using less of your available credit and could save money on interest charges by paying off your balances in full each month.

The three main factors that determine a person’s credit score are:

1) How much debt you have currently outstanding;

2) How much debt you have across all of your accounts, including mortgages and car loans; and

3) How often you pay off your debts.

A good credit score can help consumers get affordable loans, such as personal loans or mortgages. It can also help them qualify for insurance products, such as auto or homeowners coverage. There are several ways to improve your credit score.

Invest for the Long Term

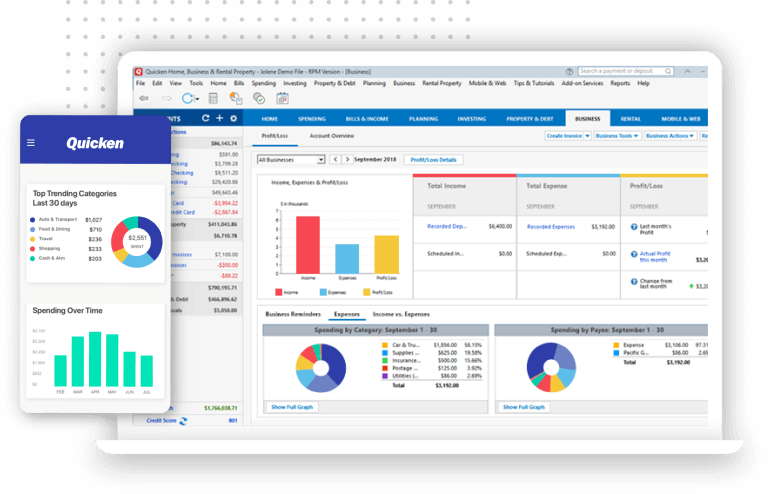

Image Source: Link

There are a few things you can do to take control of your finances and invest for the long term:

1) Establish a budget. Knowing what you’re spending every month will help you track your progress and stay on track when it comes time to save.

2) Invest in yourself! Whether that means taking some time for yourself each week or investing in classes to learn new skills, make sure you’re getting the most out of your time and money.

3) Create a savings account. If you have something saved up every month, it’ll be easier to get through tough times – no matter what they may be.

4) Automate your finances. Setting up automatic transfers from your checking account into investment accounts can help you save even more money without having to think about it.

5) Reduce your debt load. Not only will this reduce the burden on your credit score, but also it could mean big savings down the road if you decide to pay off those debts sooner rather than later.

Get Help from a Professional

Image Source: Link

When it comes to finances, many of us feel like we’re on our own. But there are professionals out there who can help take control of your money and make sure you’re making smart financial decisions. Here are six ways to get help from a professional:

- Talk to an accountant or financial planner. These professionals can help you understand your financial situation, make recommendations for improving your finances, and set up a plan to achieve your goals.

- Get a copy of your bank account and credit score. Having this information in hand will give you a better understanding of where your money is going and how you’re doing compared to other people in your same situation.

- Meet with a debt counselor or financial management therapist. These professionals can help you combat debt by providing advice on budgeting, paying off debts, and more.

- Join a credit monitoring service. This will allow you to keep track of your credit score, see if any new accounts have been opened in your name, and more importantly – stay informed about potential risks related to your debts and how best to address them.

- Speak with an attorney about bankruptcy options if things become too difficult to handle on your own. Bankruptcy may be the best solution for some people if they cannot afford their debts or if they are struggling financially due to an illness or another major life event.