Borrowell is an excellent option to explore if you need to borrow money. It searches for lenders that offer competitive rates, then matches and pairs you with the best options based on your financial situation and credit score. In this review, we investigate: What is the Borrowell Credit Score? How does it work? Does it work? Does it replace your credit report?

What is Borrowell?

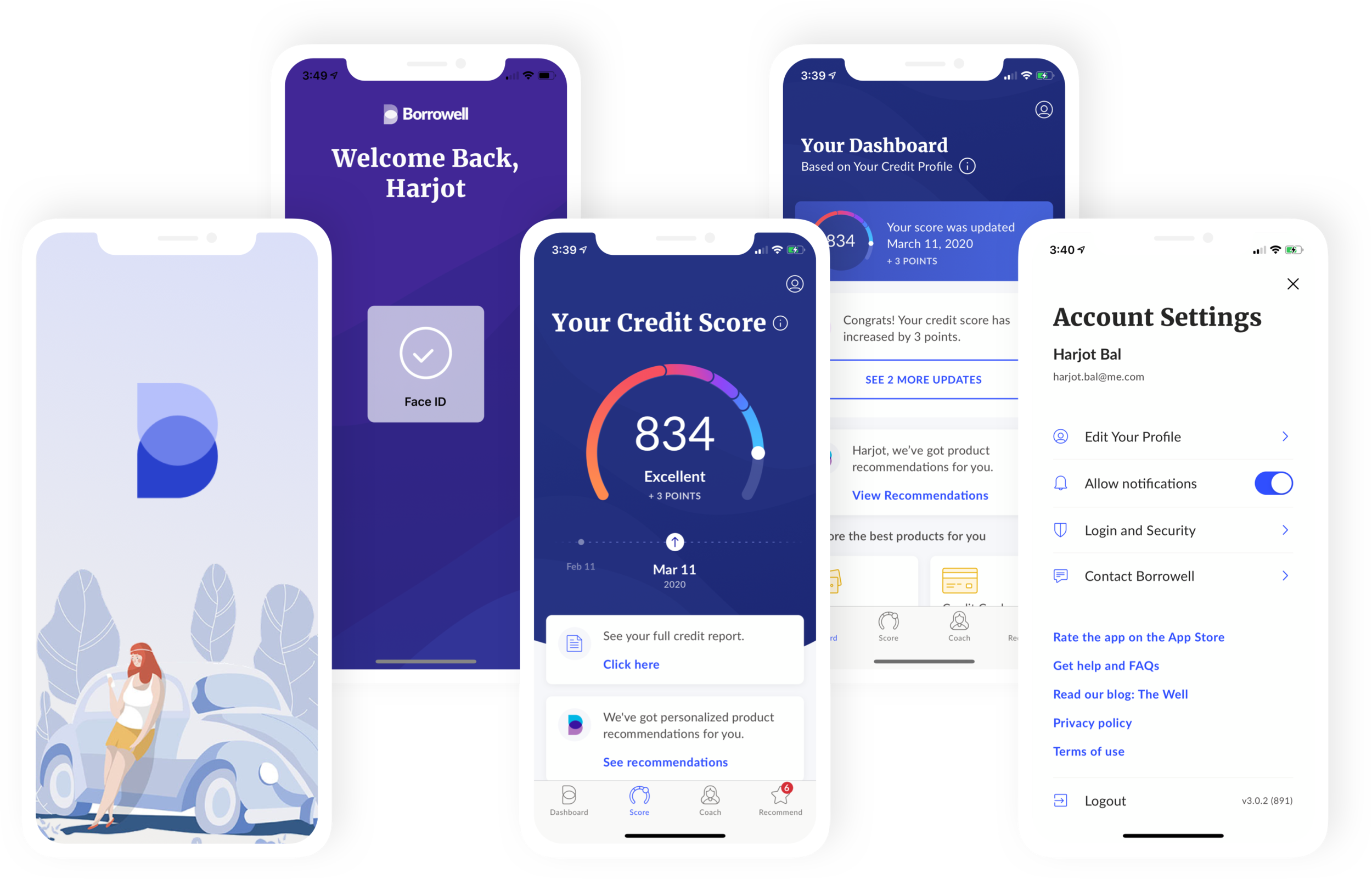

Image Source: Link

Borrowell is a free online resource that provides access to low-interest loans from multiple lenders. borrowers can check their credit scores, apply for loans, and compare rates. Borrowell allows borrowers to enter their zip code to find the best loan options available in their area.

How Does Borrowell Work?

Image Source: Link

Like many people, you might wonder how to improve your credit score. One way to do that is to check your score for free on the Borrowell website. You can also find low-interest rates on loans through this site. Here’s how it works:

1. Go to the Borrowell website and create a free account.

2. In your account’s “My Profile” section, you’ll see your credit score. This is an estimate of your creditworthiness based on information in your credit report.

3. Use the “Credit Score Simulator” tool to see how your score might change if you applied for a loan with different terms and interest rates (e.g., 6% vs. 10%).

4. You can also compare loans from different lenders and find the best one.

Pros and Cons of Borrowell

Image Source: Link

Borrowell is a great resource if you want to check your credit score for free and apply for loans at low-interest rates online. However, there are a few cons to using this service. First, you must be willing to wait a few weeks for the results of your credit check. Second, the interest rates are relatively high compared to other lenders.

Conclusion

Image Source: Link

Borrowell is a great resource for checking your credit score, applying for loans at low-interest rates, and more. They offer a free trial, so you can check it out first to see if it’s the right fit for you.