Creditkarma is a great tool for monitoring your credit score. It’s free, it is easy to use, and it provides you with real-time updates so you can make informed decisions about your borrowing capacity. In this blog post, we will provide you with tips on how to monitor your credit score using Credit karma. We’ll also discuss some important points to keep in mind when using the tool so that you can get the most out of it and stay in control of your finances.

How does Credit Karma work?

Image Source: Link

Credit Karma is a credit monitoring and management service that helps individuals better understand their personal credit score, see where they stand in relation to their peers, and take steps to improve their credit rating. Credit Karma offers a suite of tools that allow users to monitor their credit scores, track their progress over time, dispute items on their credit reports, and more.

How Credit Karma Works:

First, create an account with Credit Karma. Next, input your name, date of birth, Social Security number (if available), and other information required for a credit check. You will also be asked to provide addresses for three active accounts with at least one open debt or loan current as of the date you apply.

Credit Karma will then start working to obtain your free consumer report from Experian. This can take up to two weeks. Once your consumer report has been downloaded, you’ll be able to view it online. It’s important to note that this report does not include your private information such as your Social Security number or driver’s license number – only financial data such as your balances and interest rates on debts and loans.

You’ll be able to see how you’re doing based on the data in your consumer report and what actions you might need to take in order to improve your score. For example, if you have high amounts owed on some of your accounts or have had trouble meeting payments on time in the past, you might want to work on reducing those balances or increasing your payment frequency. You can also view information such as how many people have filed complaints against you with the three major credit reporting agencies, and find out what’s driving your bad credit score.

Once you’ve reviewed your report, you can take any necessary steps to improve your credit rating. This may include updating your contact information, reviewing your borrowing and lending history, and making a payment plan on outstanding debts. Credit Karma will provide tips and resources as you work to improve your credit rating.

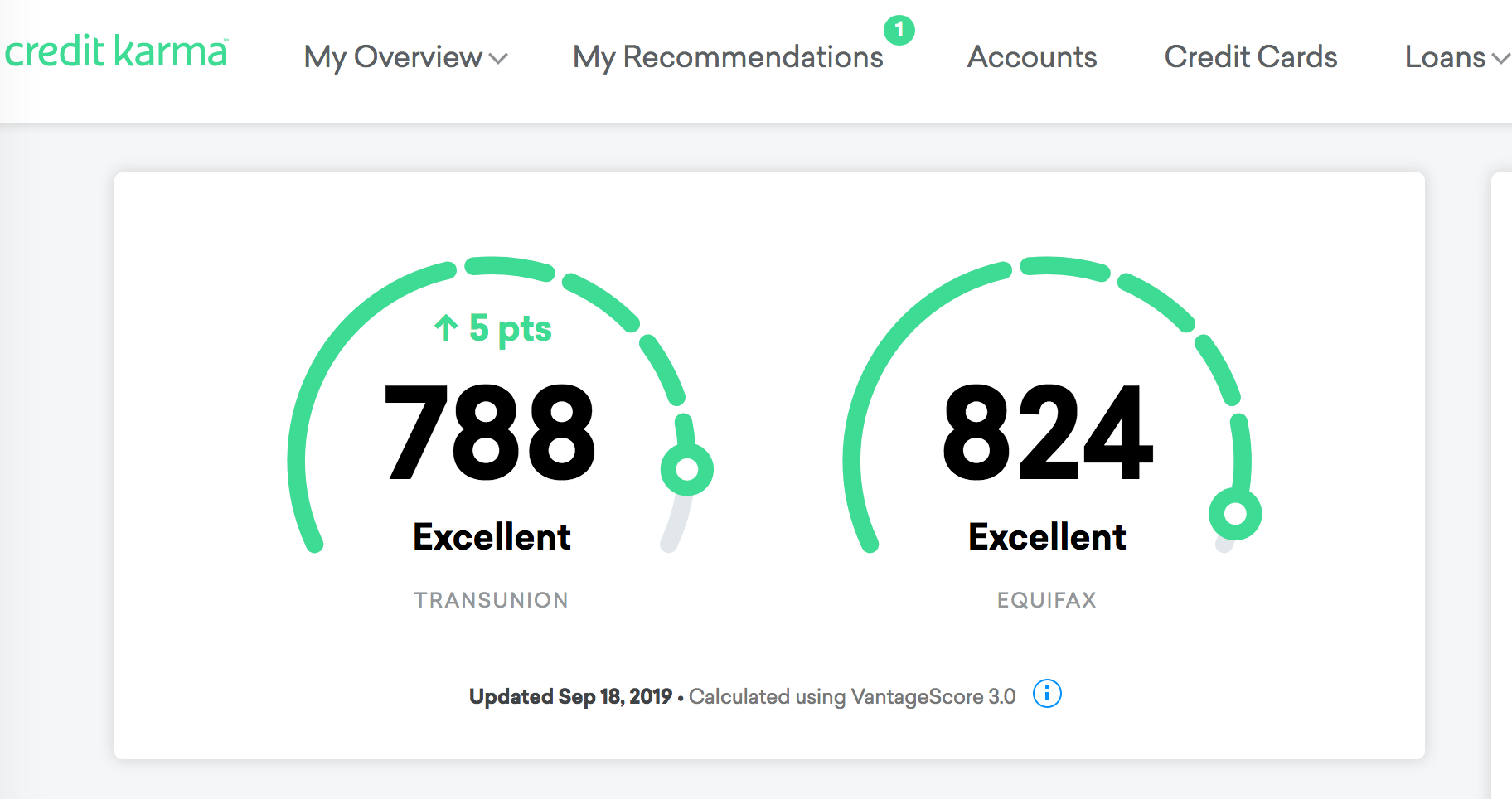

How to Monitor Your Credit?

Image Source: Link

Monitoring your credit is an essential part of rebuilding your credit rating. There are a number of ways to monitor your credit score, and each has its own set of pros and cons.

Credit monitoring services provide a snapshot of your overall credit health at any given time. They offer subscribers access to their reports online, as well as alerts when there are changes to their account status or score.

Credit monitoring also includes personal advice on how to improve your credit score and credit utilization ratio (the percentage of available credit used). While these services can be helpful in spotting potential problems early, they may not be necessary for everyone – some people prefer to monitor their own credit scores using free resources like Credit Karma or TransUnion’s MyFico tool.

Regardless of which approach you to choose, it’s important to keep up with regular monitoring so you can stay on top of any changes that could affect your credit rating.

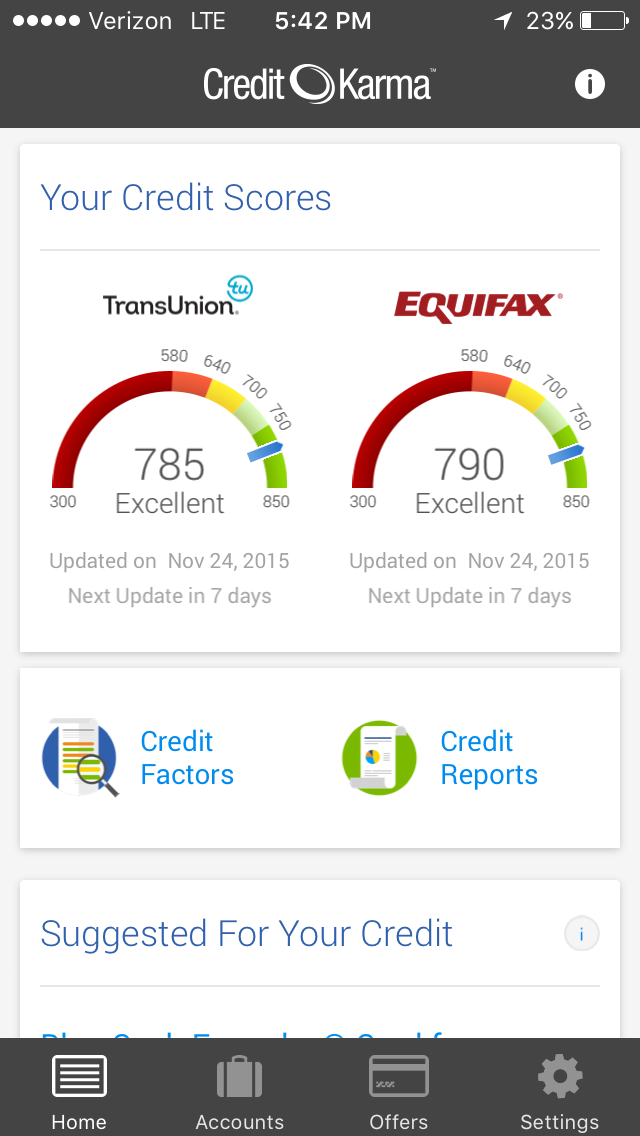

How to Get Your Free Credit Score?

:max_bytes(150000):strip_icc()/credit.karma.logo.cropped-5bfc2e08c9e77c0026b570fb.png)

Image Source: Link

Credit Karma is a great resource for monitoring your credit score. You can get your score and detailed information about your credit history, including open and closed accounts, updated on a daily basis.

To get started, sign up for a free account at Credit Karma. Once you have logged in, head over to the Credit Score section of the site. Here, you can see your current credit score and all of your historical scores.

You also have access to Debt Reports, which show how much debt you are currently carrying and how it has changed over time. This information is helpful when deciding whether or not to take on new debt or pay off old debt quickly.

If you would like to learn more about how Credit Karma can help improve your credit score, be sure to check out our full guide here: https://www.creditkarma.com/en/guide/how-to-monitor-your-credit-in-creditkarma/.

How to Improve Your Credit Scores?

Image Source: Link

Monitoring your credit score is an important part of maintaining good credit. Credit Karma offers a free annual credit monitoring service that can help you stay on top of your credit health. You can use our tools to see where you stand, track changes over time, and get alerts if your credit scores change significantly.

You should also monitor your credit report every year to make sure there are no errors or inaccuracies. You can get a free copy of your credit report from each of the three major credit reporting agencies: Equifax, Experian, and TransUnion.

To improve your credit score, make sure you always follow these tips:

- Pay your bills on time.

- Keep your credit utilization low.

- Use a creditworthy credit card.

- Stay current on your credit reports.

Conclusion

Image Source: Link

Monitoring your credit is important if you want to keep your credit rating high, as any mistakes can damage your score. You can use Credit Karma to monitor all of your accounts in one place and make sure you are always keeping up with your payments. We also offer a range of services that can help repair any damage done to your credit score, so don’t hesitate to get in touch if you need our help!