Credit card comparisons can be a fun way to see how different cards stack up against one another. But before you start comparing, it’s important to understand how credit card ratings work. A credit score is a number that lenders use to determine your eligibility for a loan. Your credit score will be based on your credit history, which includes the types of loans you’ve taken out, the amount of debt you have, and the terms of those loans. Knowing your credit score can help you compare cards more accurately because each card will have a different rating based on your credit history. And since credit scores can change over time, it’s important to check your rating regularly. To find out your current credit score, visit AnnualCreditReport.com or call Credit Karma at 1-800-989-8228.

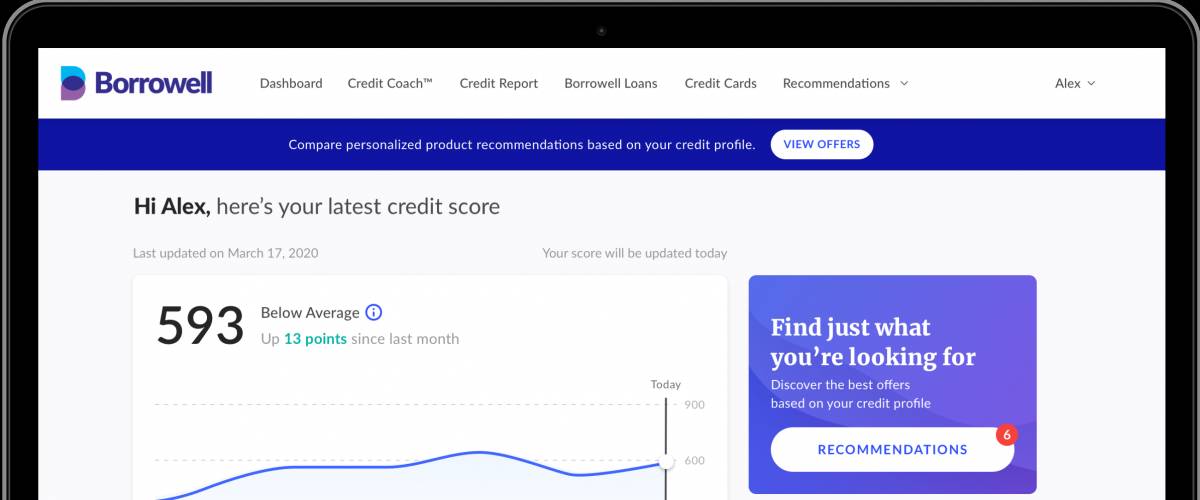

What is a credit score?

Image Source: Link

A credit score is a number that lenders use to decide whether to offer you a loan or credit card. A high credit score means you’re considered a good risk and can get a lower interest rate on loans or cards. A low credit score means you’ll likely pay higher interest rates.

There are three major credit bureaus in the U.S.: TransUnion, Equifax, and Experian. Each bureau has its own scoring model, so your score from one bureau may differ from your score from another.

To get your credit score, each bureau will request information from your credit report — which you can get free once every 12 months from each bureau. The three main factors that determine your credit score are: unpaid balances, recent payments history, and borrowing amounts (total debt).

Your credit score is used mainly by lenders when considering offers for loans and Credit Cards, but it can also be used by landlords to make decisions about approving rental applications or employers when considering an employee’s potential for accruing debt.

How does a credit score work?

Image Source: Link

A credit score is a number that reflects your creditworthiness. It’s calculated by the three main credit bureaus – Experian, TransUnion, and Equifax – and is used to determine whether you’re approved for a loan, given the amount you’re borrowing, or offered an insurance policy.

To get a good credit score, make on-time payments, keep your debt levels low and avoid taking on too much debt. A low credit score can mean higher interest rates, less favorable terms on loans, and reduced access to products like insurance.

What are the different types of credit cards?

Image Source: Link

There are many types of credit cards on the market, each with its own set of benefits and drawbacks. This article will help you compare the different types of cards and find the one that’s right for you.

RevolvingCreditCard

A revolving credit card is a type of credit card that allows customers to borrow money from the bank using their credit score as collateral. The customer pays back the borrowed money over time, with interest.

Pros: A revolving credit card can be a great way to build your credit history.

Cons: If you don’t use your card regularly, you may end up paying more in interest than if you had used a traditional loan product like a fixed-rate mortgage.

RegularCreditCard

A regular credit card is a plastic card with an account number and an expiration date. You use this card to buy things like groceries or clothes and pay off the balance each month.

Pros: A regular credit card offers lower-interest rates than some other borrowing products, such as personal loans or debt consolidation loans.

Cons: Regularcreditcards carry slightly higher fees than other types of plastic cards, such as annual fees or late payment charges.

SecuredCreditCard

A securedcreditcard is a type of plastic card that requires customers to put down a deposit before they can borrow money from the bank. The deposit protects the bank against any losses if the customer fails to repay their debt by the date specified on the card.

Pros: Securedcreditcards offer a competitive interest rate, and the deposit can be used to reduce your overall borrowing costs.

Cons: Securedcreditcards often have higher annual fees than regular credit cards.

How do you get a good credit score?

Image Source: Link

With millions of people in the United States holding credit cards, it can be hard to know which one is right for you. A good credit score is essential if you want to get approved for a loan or lease, and there are many factors that go into getting a high credit score. Here are three steps to improving your credit score:

1. Pay Your Bills on Time

This may seem like a no-brainer, but keeping your bills paid on time will help improve your credit history. If you have delinquent bills, creditors may assume that you will not be able to repay them and may lower your credit score.

2. Keep Your Credit History Clean

If you have any past debts or bankruptcies, make sure they are cleared up before applying for new credit. This includes any collections accounts that have been resolved or any debts that have been paid off. Having negative information on your credit report can negatively impact your score.

3. Use Credit Wisely

overextending yourself with credit can lead to problems down the road such as higher interest rates and missed payments. Try to use only what you need and pay off each debt as quickly as possible so that your total balance remains low on your credit report.

What are the benefits of having a good credit score?

Image Source: Link

Credit scoring is one of the many factors lenders look at when reviewing a borrowing request. A good credit score indicates that you are likely to pay your debts back in a timely manner. However, there are other benefits to having a good credit score, including:

- You may have easier access to credit products and loans, particularly if you need financing for an expensive purchase such as a home or car.

- You may be offered lower interest rates on loans and credit products.

- It can make it more difficult for creditors to pursue collection actions against you.

- If you get into financial trouble, your credit score will be an important factor in determining whether or not you can get a loan or line of credit from a lender.

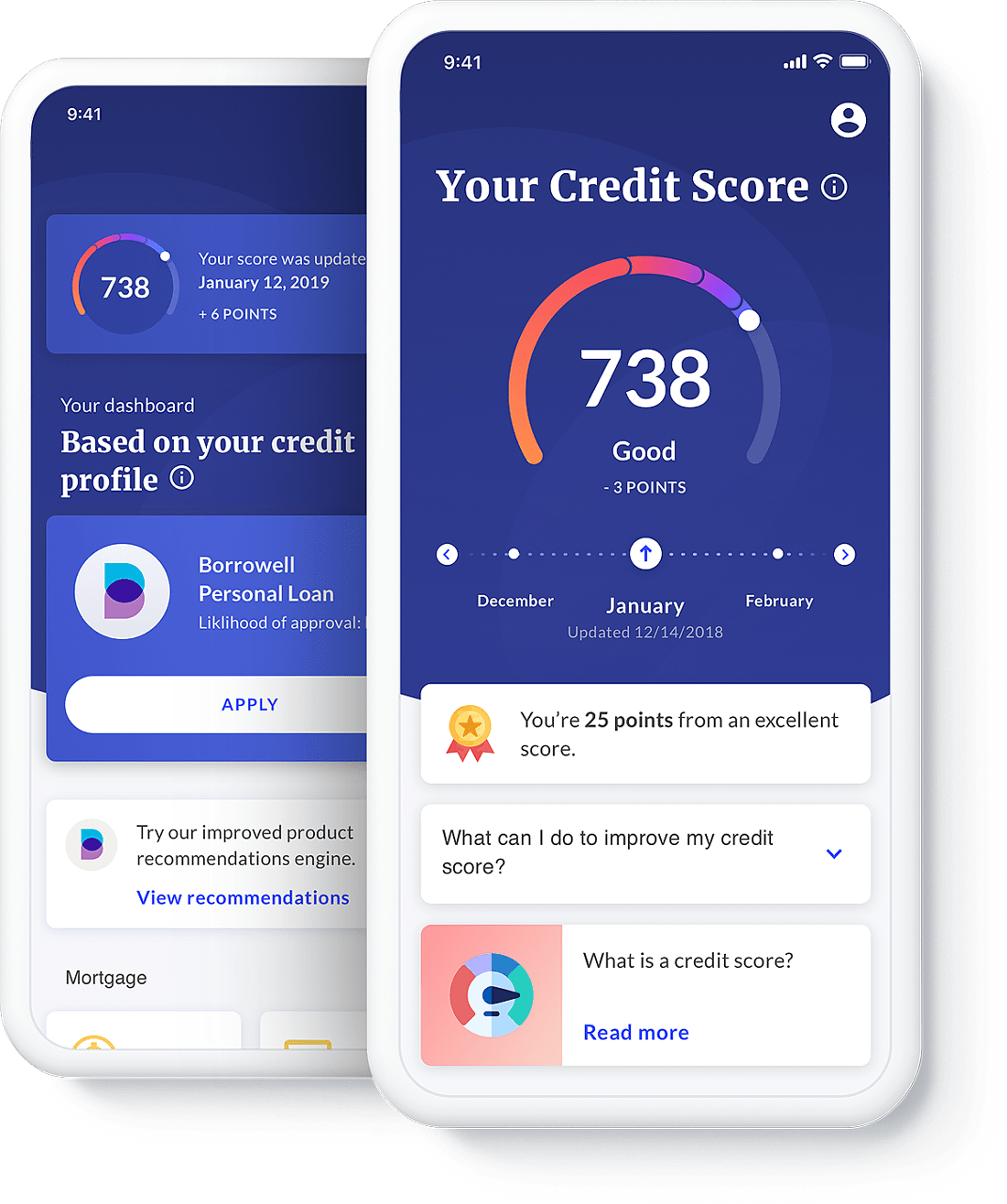

How to compare credit cards in Borrowell?

Image Source: Link

When you’re comparing credit cards in Borowell, it’s important to keep in mind your budget and borrowing needs.

Here are three tips for choosing the right card for you:

1. Know Your Credit Score

Your credit score is one of the most important factors when considering a card. A high score means you’re a low-risk borrower, which could lead to lower interest rates and fewer late payments.

2. Review Annual Fees & APR Rates

Some cards charge an annual fee, while others have higher APR rates. Pay attention to how much interest you’ll be paying annually, as well as the total cost of the card over time.

3. Consider Your Spending Habits

Before signing up for a card, take into account your typical spending habits and whether those align with the features offered by the cards you’re considering.

Conclusion

Image Source: Link

If you’re looking to compare credit cards, Borowell is a great resource. They have detailed information on each card and also offer comparisons between different categories of cards. This can be very helpful if you’re looking to find the perfect card for your needs.