There are many ways that people can check their credit score, but many of them don’t work for a Canadian citizen. Here’s a step-by-step guide to see if you have a free credit score and what it means for you.

What is your credit score?

If you’re concerned about your credit score, there are a few ways to check it for free. The three major credit bureaus in Canada are TransUnion, Equifax and Experian. Each bureau has its own website where you can access your credit report, score and history. Once you have access to your report, use the following tips to improve your score: Pay Your Bills on Time – A good credit score is based on your overall repayment history, so make sure to always pay your bills on time.

Keep Your Credit History Clean – If you have ever had any delinquent or high-interest debts, make sure to clean up your credit history by paying those debts off or settling them in a timely manner. Have a Good Amount of Debt – Having too much debt can damage your credit score.

Aim to have no more than 30% of your total indebtedness come from loans or mortgages. Make Use of Credit Counters – If you’re having trouble meeting your monthly payments on time, consider using a credit counter service that will help monitor and manage your debt burden.

There are also several personal finance websites that offer free credit scores as well as other financial advice. One example is NerdWallet, which offers articles and calculators related to money management andcredit scoring.

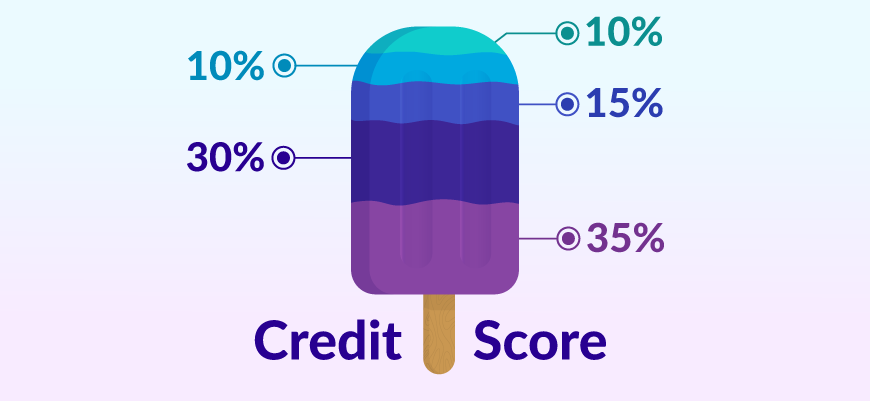

What are the different components of a credit score?

Image Source: Link

- Credit scores are composed of three major components: credit history, current credit score and payment history.

- Your credit history includes information about your loans, credit cards, and other borrowing activities.

- Your current credit score is a measure of how likely you are to pay back your debts in full and on time.

- Payment history reflects how often you have paid your bills on time.

How to keep your credit healthy?

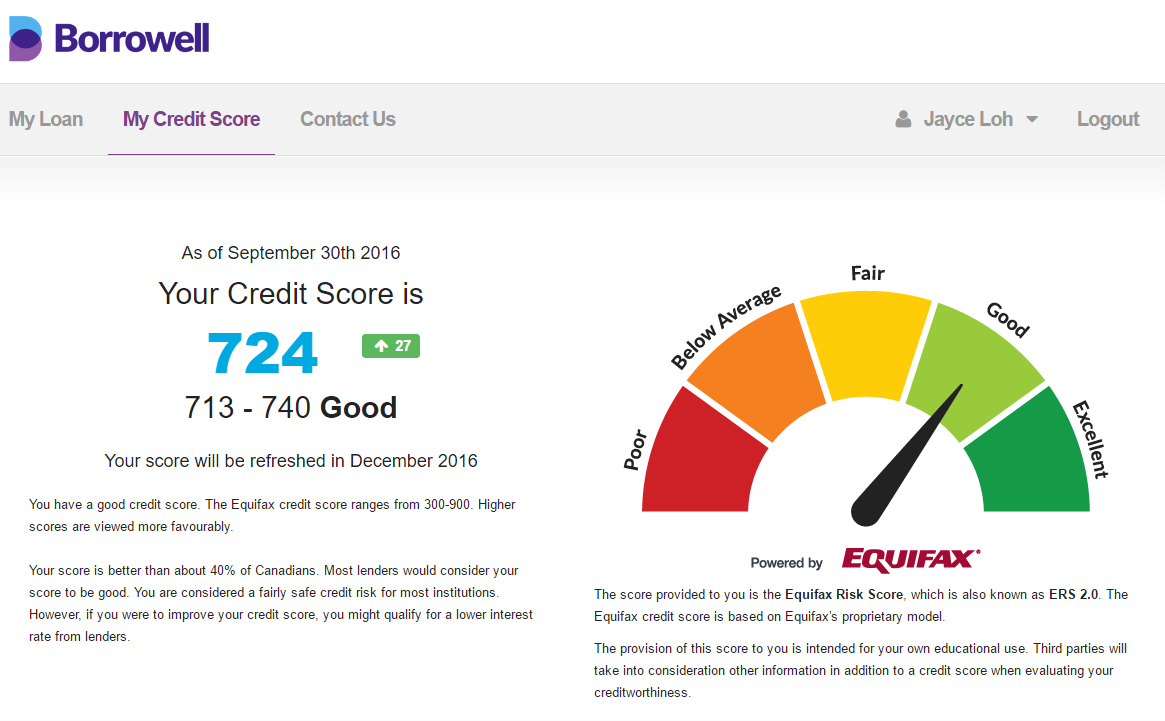

Image Source: Link

There are a few ways to check your free credit score in Canada. You can access free credit scores from three different credit bureaus: TransUnion, Equifax, and Experian. To get your free score from TransUnion, you will need to sign up for their CreditWatch monitoring service. To get your free score from Equifax or Experian, you will need to visit their websites and create an account. Once you have an account with one of the credit bureaus, you will be able to access your free score.

To get your free score from TransUnion, you will need to sign up for their CreditWatch monitoring service. This service costs $14 per year and allows you to receive alerts if your credit score falls below a certain threshold. You can also use this service to see how your scores have changed over time.

To get your free score from Equifax or Experian, you will need to visit their websites and create an account. Once you have an account with one of the credit bureaus, you will be able to access your free score. Your free score is updated once every 14 days and provides information such as the amount of debt that you owe, the average age of your accounts, and the number of open accounts that you have.

How to take control of your finances?

Image Source: Link

To check your free credit score in Canada, you can use the national credit reporting agency Equifax. The Equifax website offers a free credit score report every 14 days. You can also subscribe to their once-a-month credit monitoring service for $19.95 per year.

To get your free Equifax credit score, visit equifax.com/freecreditscore and sign in or create an account. You will need to provide your full name, date of birth, and street address. After completing the form, you will receive an email with your free Equifax credit score.

Benefits of maintaining a good credit score

Image Source: Link

Maintaining a good credit score can help you get approved for loans, lower interest rates on products and services, and reduce your risk of being sued. Here are the key benefits of having a good credit score:

- Get approved for loans: A good credit score means you’re likely to be approved for a loan, whether it’s for a small purchase or a major investment. This is because lenders look at your debt history and current financial situation when making decisions about approving or denying a loan.

- Lower interest rates: Lenders often offer lower interest rates to borrowers with good credit scores. This is because they know that you’re more likely to pay back the loan on time, which reduces their risk of losses. Plus, if you ever do need to borrow money in the future, your rate will be lower since lenders consider your credit score when setting the interest rate on a loan.

- Reduced risk of being sued: Having good credit also reduces your risk of being sued in court. The reason is simple – if someone does sue you and can prove that you owe them money, having good credit will make it harder for them to win in court since lenders are more likely to give you a fair settlement than someone with less-than-perfect credit ratings.

- More eligible products and services: Another benefit of having a good credit score is that it makes you more eligible for products and services offered by businesses across Canada.