Credit monitoring is the process of monitoring credit reports to reduce the risk of identity theft. It’s a tool that helps you uncover any potential signs of fraud on your credit report and help you dispute anything you see there. This article has tips to help you better understand how it works and what its benefits might be for you.

Credit monitoring

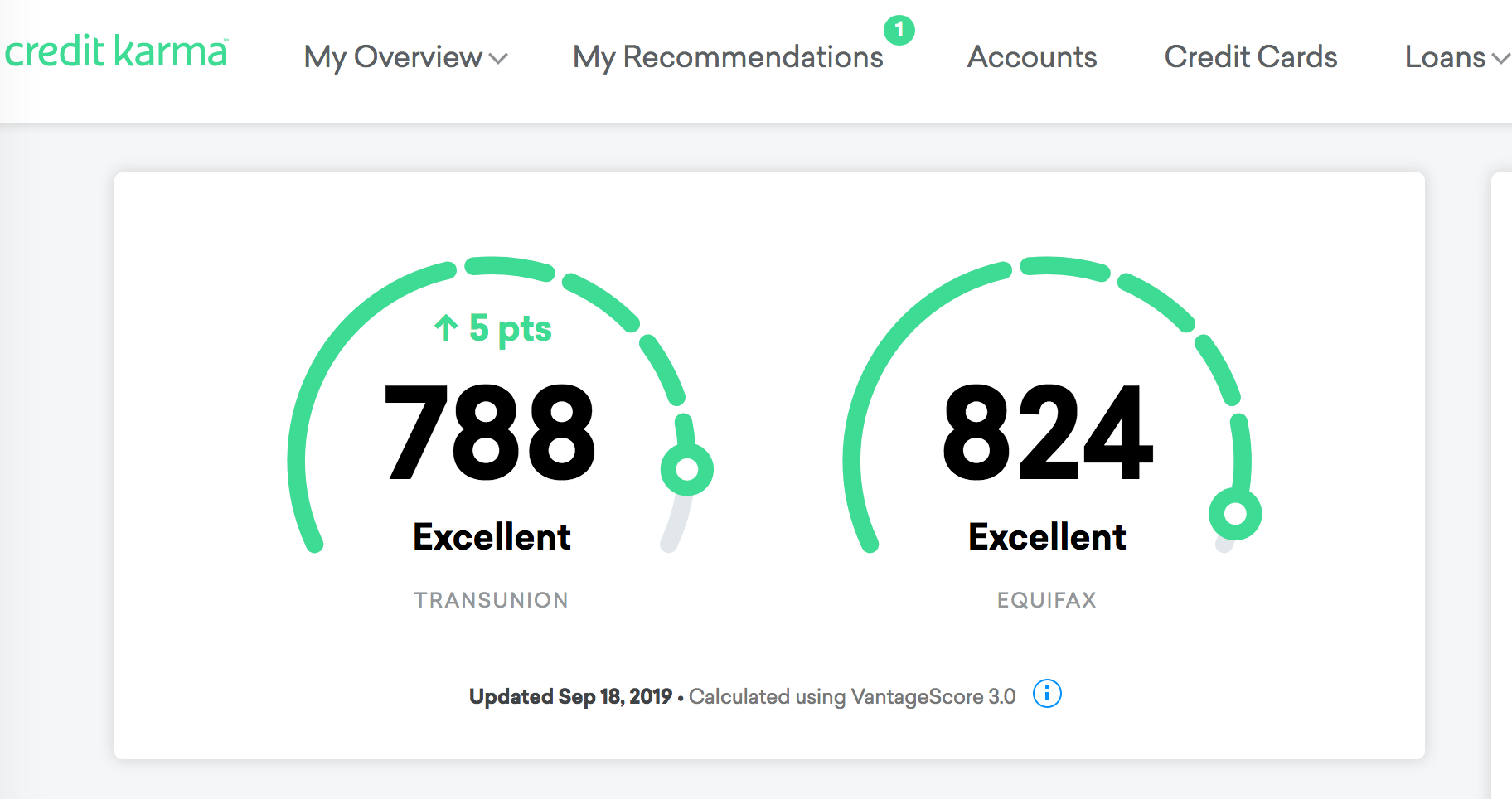

Image Source: Link

Credit monitoring is a way to make sure that you are aware of any changes in your credit score. It can help you prevent problems with your credit history, such as being denied a loan or getting a higher interest rate on a loan. There are different types of credit monitoring services. You can receive periodic alerts about changes to your score, or you can have an account where you can view all the information at once. Some services also offer tips on how to improve your credit rating.

There are several factors that affect your credit score, including how much debt you have, how long it has been since you paid off that debt, and how well you maintain your credit history. A good credit monitoring service will tell you about any changes in these factors so that you can take action if necessary.

Some things to consider when choosing a credit monitoring service include the price and features offered, the company’s reputation, and the types of reports available. Some services offer free trial periods so that you can try them out before deciding whether to buy them.

Benefits of credit monitoring

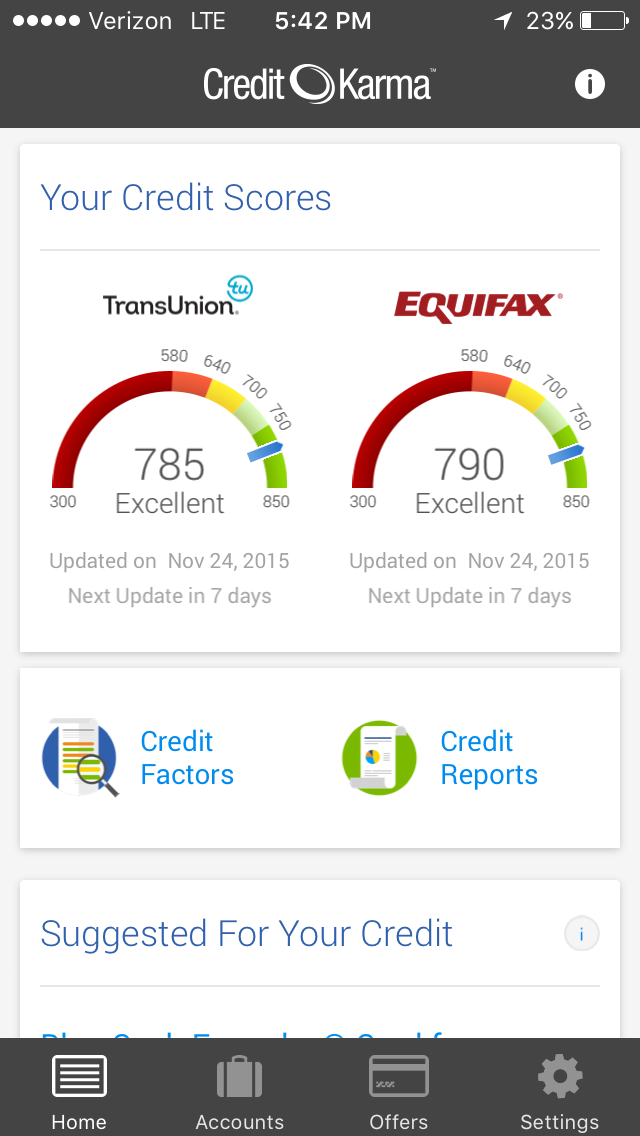

Image Source: Link

Credit monitoring is a service that provides individuals and businesses with alerts about changes in their credit score. This can help individuals and businesses monitor their credit health and make decisions about whether or not to take action, like borrowing money or extending credit. There are many benefits to using credit monitoring services, including the following:

- Keeping tabs on your credit score. Credit monitoring services can help you stay aware of changes to your credit score, which can give you a better understanding of your overall financial stability. If you see any changes that concern you, it may be a good time to review your debt situation or consider taking steps to improve yourcredit rating.

- Avoid creditors hounding you for payments. Credit monitoring services can alert you when your credit score falls below a certain threshold, which may trigger creditors to start hounding you for payments. By learning about these triggers early on, you can prepare yourself and avoid unpleasant situations.

- Monitor your borrowing behavior. Knowing what type of loans and credits you’re approved for can help you manage your finances more responsibly and avoid unnecessary debt accumulation over time. Monitoring your borrowing behavior can also prevent potential problems down the road, like high interest rates on loans or unfair terms from lenders that could damage your credit rating.

Disadvantages of credit monitoring

:max_bytes(150000):strip_icc()/credit.karma.logo.cropped-5bfc2e08c9e77c0026b570fb.png)

Image Source: Link

Credit monitoring is a service that monitors your credit score and alerts you if there are any changes. There are several possible disadvantages to using credit monitoring, including:

- It can be a waste of time and money. Your credit score will not change significantly based on small changes, so it is generally not worth the expense to monitor your score regularly. Additionally, many credit monitoring services charge high fees for their services.

- It can be intrusive and annoying. Many credit monitoring services send automated phone calls or emails notification of changes in your credit score. This can be intrusive and bothersome, especially if you do not want to receive these notifications.

- It can lead to financial harm. If you are unable to pay your bills because of an incorrect or inaccurate credit score, using credit monitoring could put you in danger of defaulting on your loans or losing your home due to missed payments.

Tips to consider

Image Source: Link

When considering how to monitor your credit, there are a few things to keep in mind. First and foremost, be aware that all three major credit bureaus (Equifax, Experian, and TransUnion) offer free credit monitoring services. While each bureau has its own features and benefits, all of them provide access to your reports online, as well as through the bureau’s customer service representatives.

Once you have determined which bureau will best suit your needs, be sure to sign up for their alerts service. This will send you email notifications whenever changes occur with your credit report. Be sure to check the legitimacy of any alerts you receive by contacting the bureau directly.

Additionally, consider using a credit monitoring tool from a third-party provider. These tools offer more comprehensive coverage than what is offered by the three main bureaus and can be more affordable. Additionally, these tools often have bonus features such as extended monitoring periods and fraud alerts that are not available from the major bureaus.

Overall, keeping tabs on your credit status is important for both personal safety and financial security. By following these tips, you can ensure that your credit reports are accurate and that any issues are immediately brought to light.

Conclusion

Image Source: Link

When it comes to credit monitoring, there are a few things you should keep in mind. First and foremost, credit monitoring services offer a way to monitor your credit reports and track any changes that may occur. This can help you identify problems early on and take steps to fix them before they become bigger issues. Additionally, credit monitoring services can also provide alerts if unusual activity is detected on your account. By being proactive about checking your credit report regularly, you can protect yourself from potential financial challenges down the road.